Trusted by more than 2 million

Providing you peace of mind 24/7/365

Your membership includes:

- 24/7/365 emergency access to an attorney-answered hotline

- Legal representation for both criminal and civil cases

- Zero attorneys’ fees for covered events—no limits, caps or deductibles

- Answers to your self-defense questions through our everyday helpline

- Unlimited access to our informative resources

- Educational events and other member-only benefits

- …and more, for less than 50 cents a day

Customize your coverage

Minor Children

Extend your protection and benefits to your children age 17 and under for coverage at home, on your property and even at the playground.

Flexible payment options

Choose monthly or annual payment options. The choice is yours! Or save with dual membership for yourself and another household member with our annual payment plan.*

HunterShield® for hunters and anglers

Get coverage related to hunting and fishing.* These laws are complex, and adding HunterShield means the Shield has your back in the great outdoors.

Multi-State Protection

Take your coverage nationwide by extending it to the entire country, including Washington, D.C. and Puerto Rico.

Bail Bond and Expert Witness

Get bond fee protection* for bail up to $50,000 and an expert witness at trial, if necessary.

Gunowner Identity Theft Coverage

Protect your name and right to carry* in case of a stolen firearm and/or compromised ID.

Become a member and you’ll get:

Immediate protection

Coverage from the moment you

sign up

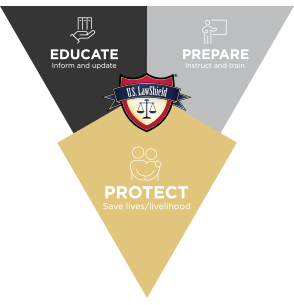

Essential resources

Legal updates and additional training through in-person events

Peace of mind

An experienced lawyer who’s always ready to assist you